From 1 July 2021, distance selling thresholds will be replaced by a Europe-wide deminimis limit of €10,000. Low Value Consignment relief for goods under €22 will also be removed.

VAT on B2C sales will have to be accounted for in the Member State of consumption. However, businesses supplying goods and services on a B2C basis will have the option of having a single OSS registration rather than having to register for VAT in multiple Member States.

The OSS is an umbrella term for a number of different schemes; The Non-Union OSS, the Union OSS, and the Import OSS (“IOSS”) which cover different types of supplies as outlined below:

Non-Union OSS

The Non-Union OSS is intended to replace the Mini One Stop Shop (“MOSS”) and can be used by non-established businesses selling services to consumers in the EU. Whereas MOSS is only used for telecommunications, broadcasting and electronic services (TBE), the Non-Union OSS will be extended to cover a number of other “where performed” services such as hotel and accommodation services and immovable property related services and may be extended to cover more services over time.

IOSS

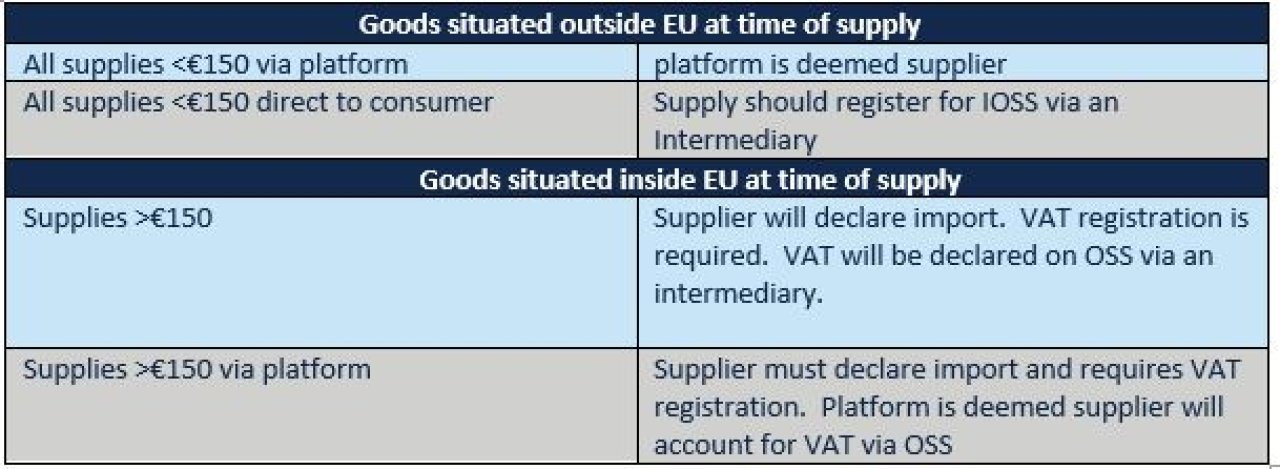

The IOSS covers goods delivered from outside the EU to consumers inside the EU where the intrinsic value of the goods (without transport costs or taxes) is less than €150. Duty is not payable on items under €150. IOSS cannot be used for excise goods. A business using IOSS will be required to appoint an intermediary to account for VAT on their behalf. Goods which are held in a warehouse within the EU are treated as being within the EU and therefore IOSS cannot be used. A business will have to use OSS or a domestic VAT return to account for sales from the warehouse.

Union OSS

The Union OSS is intended for B2C supplies of goods or services. A business using OSS is only required to register for OSS in a single Member State. Where a business has establishments in a number of Member States, it can choose which one it registers for OSS from.

Marketplaces

Marketplaces may become liable to account for VAT on B2C sales when goods are supplied by a non-established taxable person to consumers in the EU via a platform. In such cases, the platform/marketplace will be treated as the deemed supplier and required to account for the VAT. Marketplaces will declare the output tax either via OSS or IOSS.

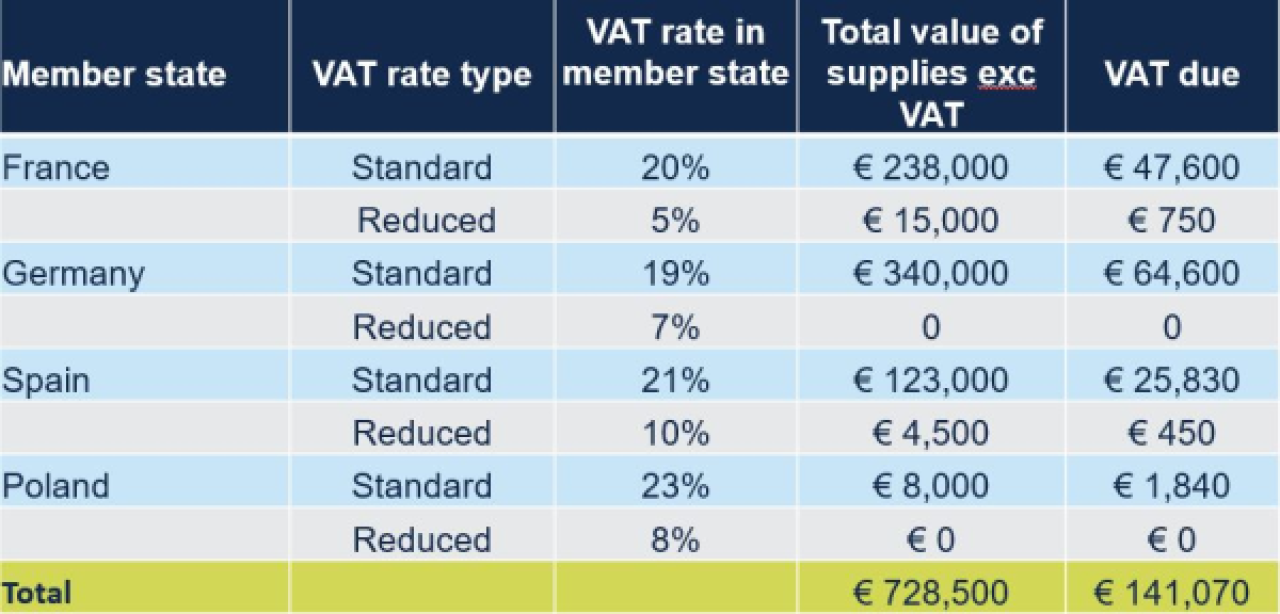

OSS Returns

IOSS returns will be submitted monthly but OSS returns will be submitted quarterly. The return will set out the VAT due in each member state.

It is not possible to recover input tax via an OSS return so if a business incurs input tax in making its supplies it will need to consider the best way of recovering the VAT, either via VAT registration, Thirteenth Directive claim or EU refund scheme.

Summary

The OSS will not necessarily remove the requirement for a non-established business to register for VAT in the EU. If a UK business moves goods into a warehouse in the EU it will be required to register for VAT and declare any import VAT and duty at the point of importation. However, VAT on sales can be accounted for via one of the OSS variations.

As an example, these options could apply to a UK business (with no EU establishment) making making B2C supplies in the EU:

Strategy

As outlined above, the position is complex. UK businesses making B2C supplies are advised to consider their strategy now. Whilst the OSS may provide some solutions, it may not provide a complete solution for dealing with all transactions.

Take Action Now

Please contact us to discuss the challenges you are facing and the solutions available to you by calling 0845 555 8844 or simply complete our enquiry form. Don’t wait, take advice now, we are here to help you.