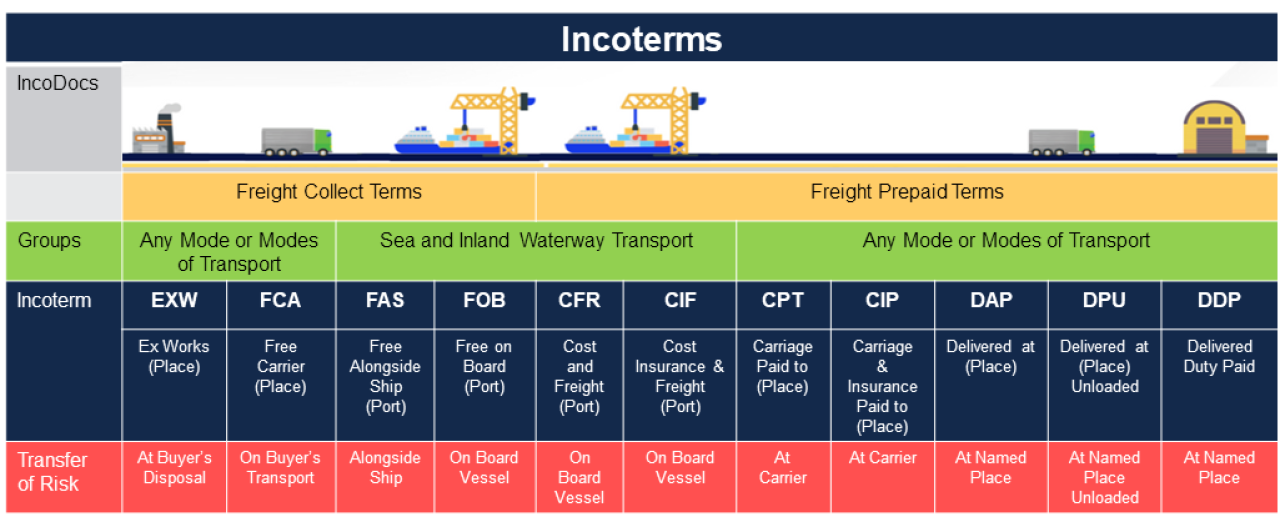

Incoterms have now become increasingly important as they identify who is responsible for import and export documentation. This can also dictate whether a VAT registration is required outside of the UK. Getting this documentation wrong can mean a hefty expense for your business as well as potential delays at the ports and problems with customer satisfaction.

Many UK businesses may have agreed to supply their European customers on a DDP (delivered duty paid) basis to reduce the administrative burden for the customer. However, this makes the supplier the importer of record and can result in a requirement to register for VAT and account for VAT on sales in the country of destination. This can be an expensive and complicated business.

If buying EXW (Ex Works) from an EU supplier, there could be a requirement for the UK customer to declare imports into Europe or use transit procedures.

There are many alternatives, but in the first instance you need to assess your supply chain carefully. What worked for the business before Brexit may no longer be viable and you may want to consider changing the incoterms or changing the route to market. You may even want to consider importing directly into mainland Europe or setting up EU entities if you are looking for a long-term solution.

Take Action Now

Please contact us to discuss the challenges you are facing and the solutions available to you by calling 0845 555 8844 or simply complete our enquiry form. Don’t wait, take advice now, we are here to help you.